AM/FM Radio, Podcasts, and Streaming Lead the Way In Amazon Prime Day 2025 Purchases

- Media Logic Radio

- Jul 30, 2025

- 3 min read

July 29, 2025

Article Courtesy: insiddradiol.com

Retailers hoping to boost e-commerce performance may want to crank up their audio budgets. A new study from Quantilope reveals that ad-supported audio, led by AM/FM radio, drove more purchases than any other media during Amazon Prime Day 2025. The findings, as outlined in the latest Cumulus Media | Westwood One blog position audio as a top-performing channel for retail advertisers and a key complement to traditional TV.

According to the national study of 925 Americans, 53% of AM/FM radio listeners made purchases during the July 8–11 Prime Day event, outperforming ad-supported music streamers (47%) and podcast listeners (44%). In comparison, online video viewers, social media users, and traditional TV audiences were less likely to shop the sales event.

The report underscores that ad-supported audio consumers are more likely to be Amazon Prime members, spend more online, and show higher awareness of retail events. Compared to the U.S. average, heavy audio users are 15–17% more likely to have Prime memberships, while heavy TV viewers are 14% less likely.

Heavy AM/FM radio and podcast listeners also reported the highest monthly Amazon spend, with a significant portion spending more than $200. MRI-Simmons data backs this up, showing that heavy radio and podcast audiences outspend TV viewers in online retail activity over the past six months.

Awareness of Amazon Prime Day was also highest among heavy ad-supported audio users, with that group most likely to report being “extremely” or “very” familiar with the event.

The effectiveness of audio advertising was evident in ad recall as well. When respondents were exposed to a 2025 Amazon AM/FM radio ad, 46% remembered hearing it, and nearly 70% said they would visit Amazon or search for deals as a result.

A Decade of Audio-Driven E-Commerce

This isn’t a new trend. Dating back to the first Prime Day in 2015, studies have shown AM/FM radio to be a top driver of purchase conversion. That year, an IPSOS study revealed that 52% of those exposed to AM/FM ads made a purchase—outpacing TV (39%) and online (48%).

A 2018 follow-up study found that heavy AM/FM listeners were 51% more likely to be Prime Day purchasers than heavy TV viewers. And more recently, a December 2023 MARU/Matchbox study confirmed that heavy podcast and AM/FM users were also more active during Amazon’s Big Deal Days event.

“20 Gets You 50”: Audio Boosts TV Campaign Reach

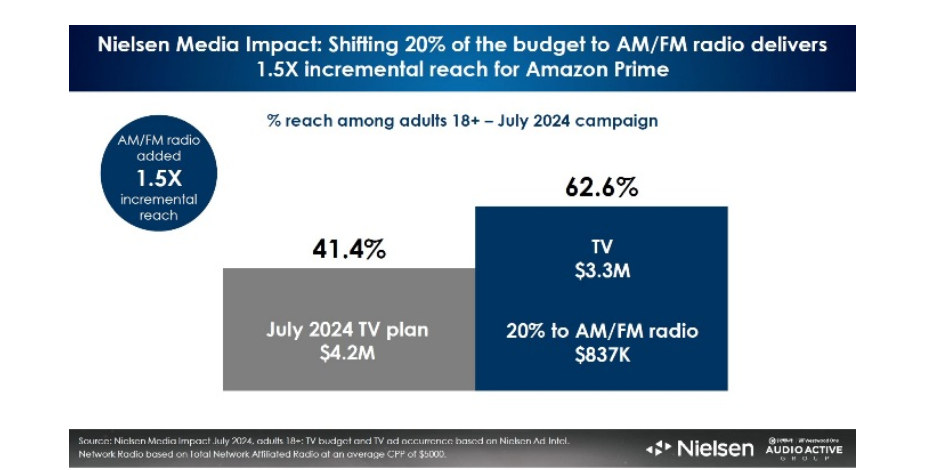

One of the study’s most actionable insights for media planners is the effectiveness of integrating AM/FM radio into television-heavy media buys. According to Nielsen Media Impact, shifting just 20% of a TV media plan to AM/FM radio can increase campaign reach by more than 50%, especially among adults 18–49 and light TV viewers.

TV buys tend to over-deliver to older audiences while falling short with younger demographics. But the 20% shift to AM/FM radio dramatically increases reach among hard-to-reach age groups:

Ages 18–24: +126%

Ages 25–34: +130%

Ages 35–44: +86%

Ages 45–54: +53%

It’s even more dramatic among light and medium TV viewers, where AM/FM radio adds a 131% and 38% lift, respectively—reaching consumers who otherwise wouldn’t see TV ads at all.

AM/FM Delivers ROI for Retailers

In terms of ROI, audio continues to deliver. Nielsen sales effect studies reveal that AM/FM radio retail campaigns generate $15 in incremental sales for every $1 invested. This was reinforced in a December 2023 study that found consumers exposed to Amazon’s holiday radio campaign demonstrated stronger brand familiarity, recall, purchase intent, and overall favorability.

Bottom Line

Amazon Prime Day 2025 offered yet another proof point that AM/FM radio, podcasts, and streaming audio aren't just add-ons—they’re critical performance media. As retailers gear up for the holiday season, reallocating even a fraction of TV spend to audio could result in broader reach, younger audiences, stronger brand equity, and significantly higher returns.